Cryptocurrencies all

There are other platforms that do not place a limit on the total number of coins to be issued. Like governments minting fiat, these platforms have the ability to continue creating and distributing coins in perpetuity https://greenleafsupplements.com/. Some distribute their coins by selling them, while others give them away in exchange for actual work done in support of the project.

Cryptocurrencies differ in terms of how their monetary value is established. Bitcoin’s monetary value is almost entirely dependent on supply and demand. Knowing that there is only a limited supply of bitcoins, prices go up or down commensurate with demand. If more people are buying than selling, the price goes up. Prices fall when and as sellers outpace buyers.

Much of this may not mean anything to you if you only have a cursory knowledge of how cryptocurrencies work. Suffice it to say that not every project marketed as a cryptocurrency project meets all six of the criteria. Libra is a good example.

Rewarding miners is the way the Bitcoin network gets new coins distributed. Miners can either hold on to their coins or sell them on the open market. Either way, coins are released and traded as a result of mining.

At least in its initial launch, Libra will not be completely decentralized. Facebook has said it will be several years before the Libra Association gains full and complete independence. Until then, Facebook will still control the project. For as long as they do, Libra will not be decentralized.

Are all cryptocurrencies mined

Mining has surged in popularity in recent years and could represent more than 2% of the annual US electricity consumption, according to a 2024 report by the US Energy Information Administration. One 2021 study found that Bitcoin used more electricity than the entire country of Argentina.

Bitcoin mining is highly competitive, and miners must invest in powerful machines and pay for electricity. The reward halving that occurs approximately every four years ensures that Bitcoin becomes scarcer over time, contributing to its value.

Mining has surged in popularity in recent years and could represent more than 2% of the annual US electricity consumption, according to a 2024 report by the US Energy Information Administration. One 2021 study found that Bitcoin used more electricity than the entire country of Argentina.

Bitcoin mining is highly competitive, and miners must invest in powerful machines and pay for electricity. The reward halving that occurs approximately every four years ensures that Bitcoin becomes scarcer over time, contributing to its value.

A business structure can be a good idea if your mining operation has multiple owners. You can create a business contract that outlines details like ownership stake and what percentage of profits each owner is entitled to.

Bitcoin mining uses large amounts of electricity, which many argue adversely impacts the environment. Some argue Bitcoin miners use more electricity than some countries such as Argentina, and that much of this energy comes from dirty sources. Proponents argue that mining helps stabilize grids, gives opportunities to people in remote regions to earn a living where there are few other options, that much of the electricity used would have otherwise been wasted, and that the source of mining hashpower is becoming more renewable every year.

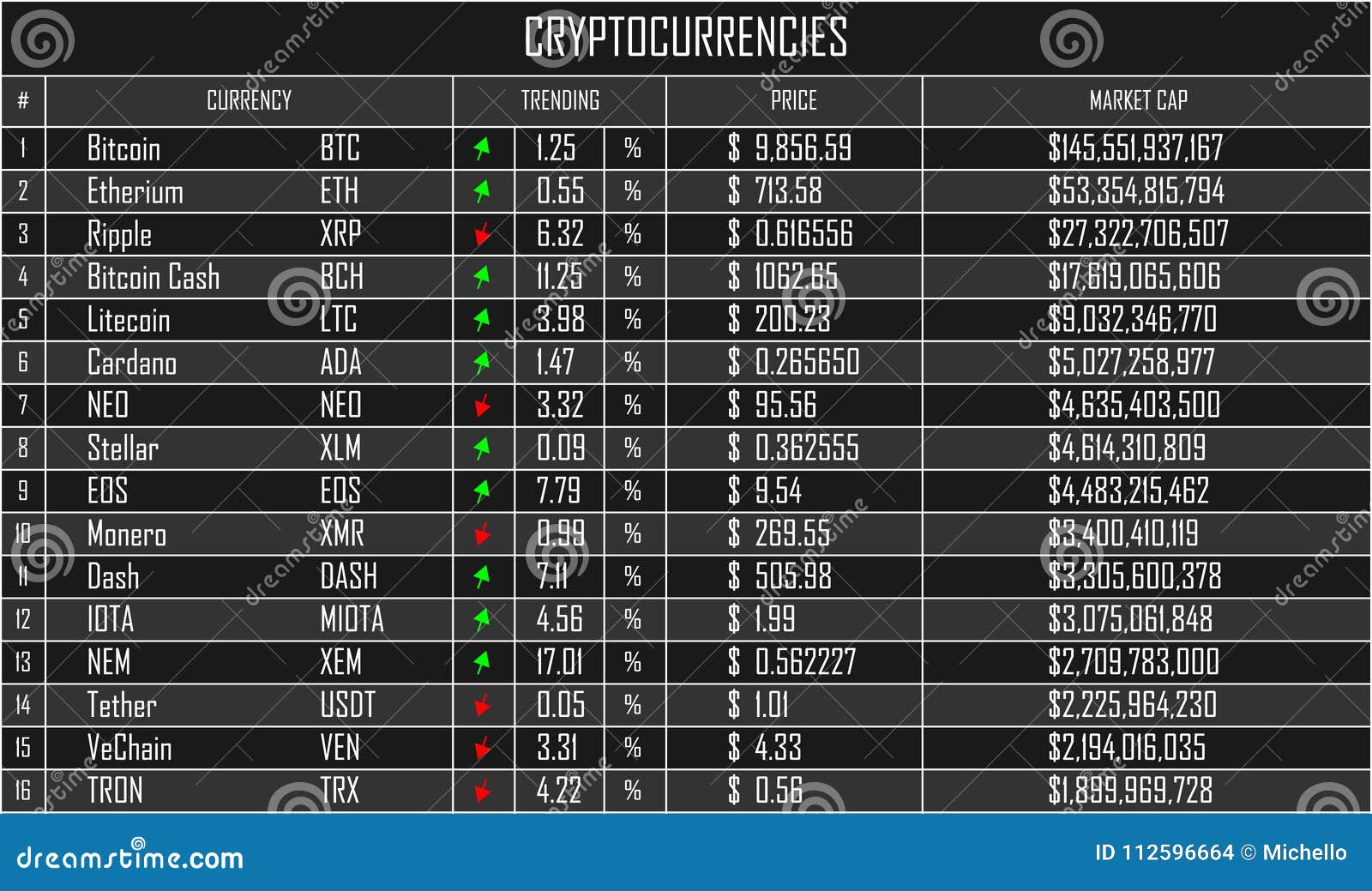

List of all cryptocurrencies

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.